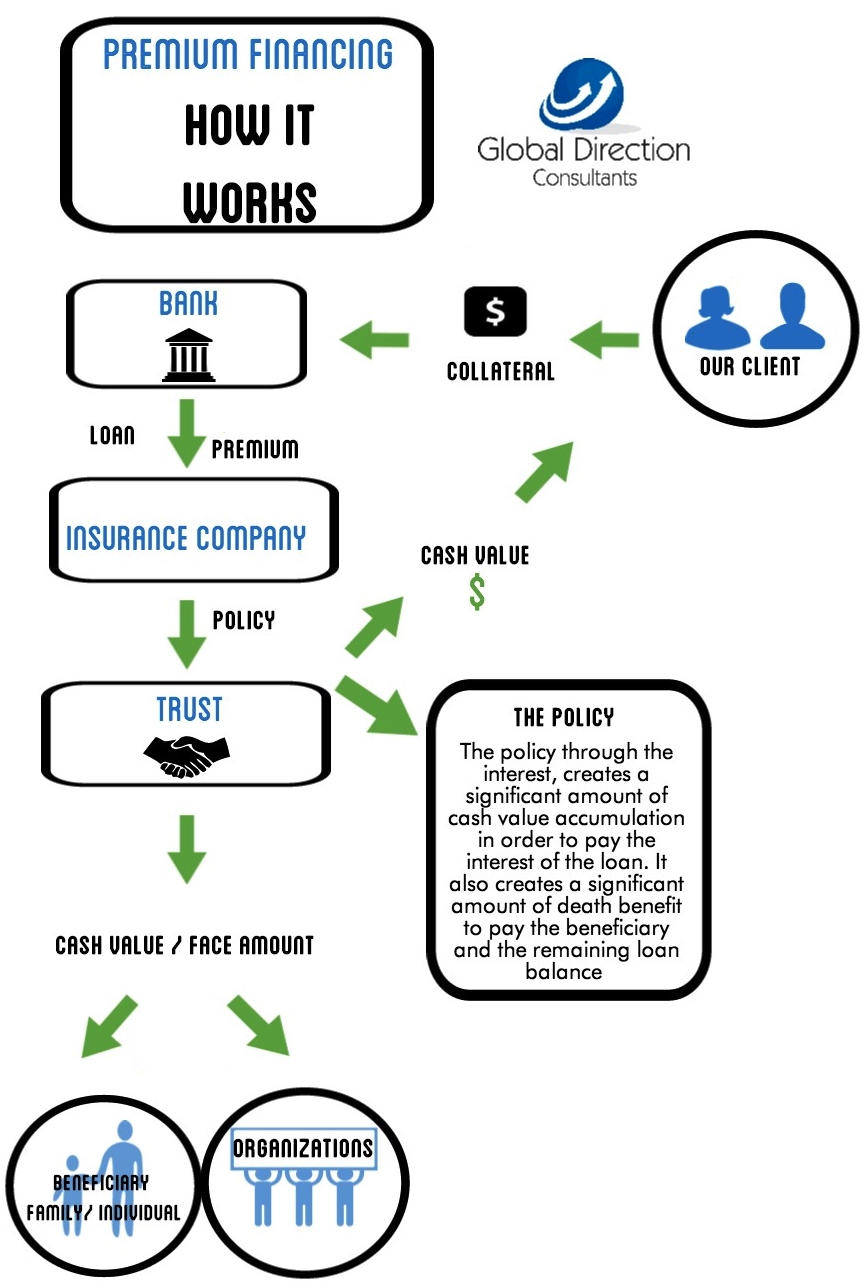

How it works:

Through the use of financed life insurance our clients can attain significant amounts of life insurance and cash values.

Steps:

- Qualify for life insurance underwriting requirements

- Qualify for "Know Your Client" loan requirements from financial institution

- Creation of a Trust to protect the insurance policy cash values and face amount.

- Financial Institution lends premium amount to lender using collateral without affecting the client's cash flow

- Policy creates significant amount of cash value to pay interest loan

- Death benefit pays remaining loan balance and a significant amount to beneficiary (Foundation/Non-Profit organization or individual's family)

Benefits:

For Foundations/ Non-Profits:

- Maximize the original donation for longer periods of time.

- Allow donors and board members to participate in the program leaving a legacy behind for their foundation and organization.

- Through the use of premium financing, foundations and organizations can reach sustainability by creating endowments and significant amount of life insurance.

For Individuals:

- Maximize insurance amounts without affecting clients' out-of-pocket expense and cash flow.

- Set up policy in such a way that client can receive significant amounts from cash value during life.

- Allow clients to significantly give to their families and their charities of choice without affecting their cash flow and portfolio liquidity.

Premium financing allows clients to attain significant amounts of life insurance without affecting their cash flow. Using financial strategies through our programs, clients can attain significant amounts of life insurance and cash values and leave a legacy to their families and charities of choice.

Organizations are able to use the original donation as they usually invest it and at the same time generate significant amounts through the use of premium financing:

1) through the cash value of the policy

2) through the death benefit.

Organizations can use our program as a tool for better and more efficient planned giving for their high dollar amount donors.

Statements on this website provide general information only, they do not take into account any organization's personal objectives, financial situation and/or present insurance needs. Organizations and individuals should obtain specific advice regarding their own circumstances before making any insurance, tax, legal and/or financial decision